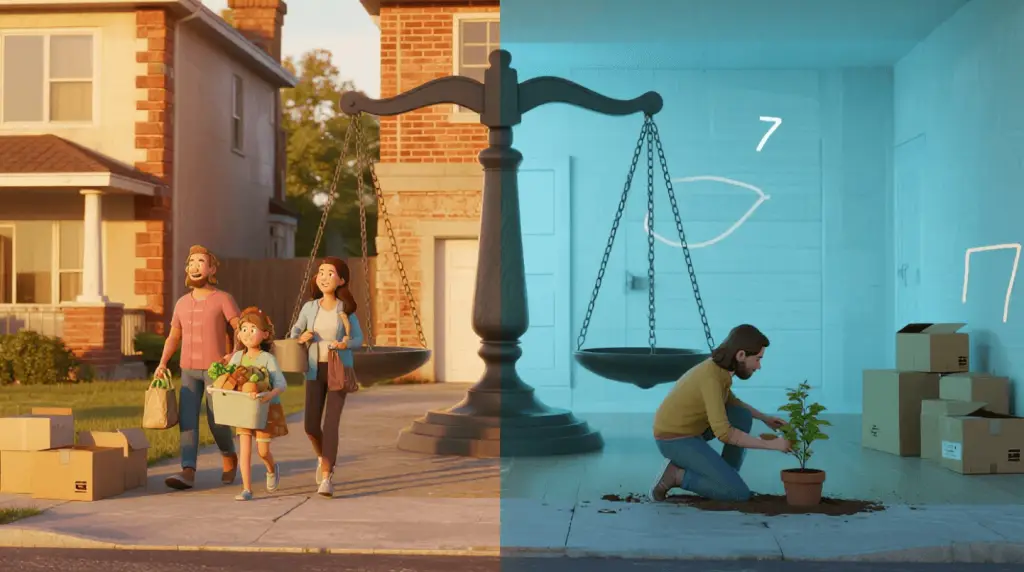

With over 387,000 bankruptcy filings in 2023according to U.S. Courts data, millions of Americans face the critical decision between Chapter 7 and Chapter 13 bankruptcy when confronting personal insolvency. This comprehensive guide examines both bankruptcy options through legal frameworks, financial impacts, and real-world case studies to help you determine the optimal path for debt relief while maintaining essential legal protection.

A 2023American Bankruptcy Institute study reveals that 72% of Chapter 7 filers successfully discharge unsecured debts within 4 months. Consider Sarah, a Tennessee nurse whose $45,000 medical debt was completely eliminated through Chapter 7 while retaining her primary vehicle and home equity under state exemptions. This rapid debt resolution makes Chapter 7 bankruptcy particularly effective for individuals facing personal insolvency with limited disposable income.

The U.S. Courts report shows Chapter 7 accounts for 63% of all consumer bankruptcies, with median attorney fees of $1,450. The means test threshold varies by state - for example, California's 2024 limit is $66,861 for single filers. These bankruptcy statistics demonstrate Chapter 7's accessibility for low-to-moderate income households seeking legal protection from creditors.

Unlike Chapter 7 bankruptcy's liquidation model, Chapter 13 establishes a 3-5 year court-approved payment plan. Debtors repay an average of 30-50% of unsecured debts while maintaining asset ownership. The Consumer Financial Protection Bureau notes this bankruptcy option helps 89% of filers avoid foreclosure through catch-up payment arrangements.

The Thompson family's case demonstrates Chapter 13's benefits - with $92,000 annual income, they restructured $28,000 in credit card debt while saving their Phoenix home from foreclosure. This bankruptcy solution proves particularly valuable for homeowners and those with nonexempt assets exceeding Chapter 7 limits, providing structured legal protection throughout the repayment period.

The bankruptcy means test remains the primary differentiator - Chapter 7 filers must demonstrate income below their state median (e.g., $58,114 in Texas for 2024). Chapter 13 has no income maximum but limits unsecured debt to $465,275. These bankruptcy qualifications significantly influence which path offers appropriate legal protection for your financial situation.

Experian data shows Chapter 7 bankruptcy remains on credit reports for 10 years versus 7 years for Chapter 13. However, FICO research indicates Chapter 13 filers often rebuild credit 18-24 months faster due to demonstrating consistent repayment behavior during their bankruptcy term. Both options initially lower scores by 130-200 points, but strategic financial management can restore scores to 680+ within 3-5 years.

Bankruptcy attorneys recommend analyzing: 1) Current income versus state median, 2) Priority debt obligations, 3) Asset protection needs, and 4) Long-term financial goals. This bankruptcy assessment framework helps determine whether Chapter 7's swift discharge or Chapter 13's repayment structure better addresses your personal insolvency challenges while maximizing legal protection.

Both bankruptcy types trigger an automatic stay - a powerful legal protection that immediately stops collections, lawsuits, and wage garnishment. A 2023 National Bankruptcy Forum study found 94% of filers reported immediate relief from creditor harassment. For small business owners like David R. (case study), this bankruptcy provision provided critical breathing room to restructure operations while maintaining cash flow.

When evaluating Chapter 7 vs Chapter 13 bankruptcy, consider consulting with a qualified bankruptcy attorney. The American Bar Association reports that filers with legal representation are 3.2x more likely to successfully discharge debts. Remember that bankruptcy represents a legal tool for personal insolvency resolution, not financial failure - with proper planning, both options can pave the way for renewed financial stability.

Disclaimer: This content regarding Chapter 7 vs Chapter 13 bankruptcy is for informational purposes only and does not constitute legal or financial advice. Consult qualified professionals before making bankruptcy decisions. The author and publisher disclaim liability for actions taken based on this content.

Michael Sterling

|

2025.08.06